Market Behavior Diagnostic Summary: 8556148530, 6154692789, 651711789, 368600411, 120354262, 914059862

The market behavior diagnostic summary for identifiers 8556148530, 6154692789, 651711789, 368600411, 120354262, and 914059862 presents a detailed examination of trading volume and volatility. These identifiers reveal significant fluctuations that correlate with changing investor sentiment and broader economic conditions. Understanding these dynamics is essential for investors aiming to navigate the complexities of the market. The implications of these findings could significantly impact investment strategies moving forward.

Overview of Market Behavior Identifiers

Market behavior identifiers serve as critical indicators that analyze trends, patterns, and anomalies within financial markets.

These identifiers reflect market dynamics, offering insight into investor sentiment and decision-making processes. Behavioral indicators, such as trading volume and volatility, enable analysts to interpret market movements and forecast potential shifts.

Understanding these metrics is essential for investors seeking to navigate the complexities of financial landscapes effectively.

Analysis of Key Market Trends

How do recent shifts in economic indicators influence market trends?

Analyzing current data reveals that rising market volatility correlates with fluctuating consumer sentiment. Increased uncertainty prompts consumers to reassess spending habits, impacting demand across sectors.

Consequently, businesses must adapt strategies to navigate these changes, focusing on resilience and innovation to maintain competitiveness in an evolving economic landscape driven by consumer behavior and external pressures.

Implications for Investors

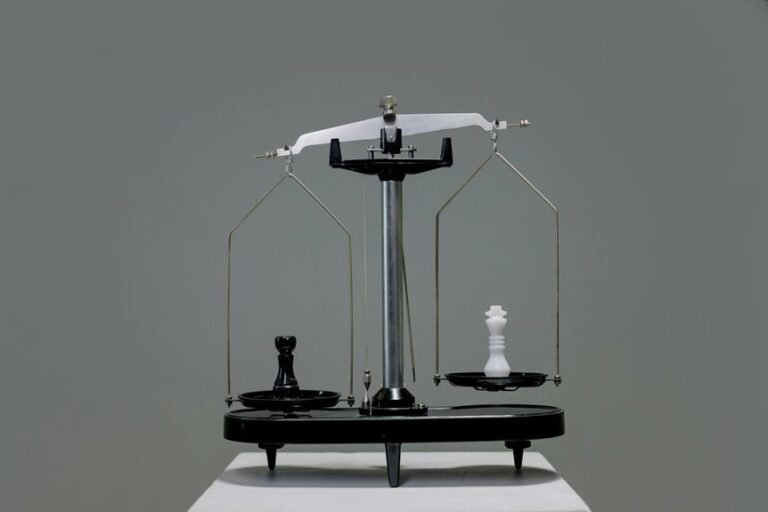

In light of recent economic fluctuations, what implications do these changes hold for investors navigating the current landscape?

Investors must prioritize risk assessment to understand potential vulnerabilities in their holdings.

Furthermore, portfolio diversification remains crucial, as it mitigates risks associated with market volatility.

Strategic Decision-Making Insights

What factors should guide investors in their decision-making processes amid ongoing economic shifts?

Employing data-driven strategies is essential, as they provide objective insights into market trends.

Additionally, understanding behavioral economics can illuminate investor psychology, revealing biases that may affect decision-making.

Conclusion

In a world where market behavior is akin to a soap opera—full of dramatic twists and turns—investors must don their detective hats to decipher the melodrama of identifiers 8556148530, 6154692789, and others. As volatility pirouettes and trading volume waltzes, one might wonder if the true asset at play is the investor’s sanity. Ultimately, the wisdom gleaned from these fluctuating narratives serves as both a cautionary tale and a clarion call for strategic vigilance in the financial arena.